29 HQ Images Cash App Bitcoin Taxes - Can I Send Bitcoin To Cash App | CryptoCoins Info Club. When you sell your property and receive the cash value of that gain, the gains become realized, and you have a taxable. The app might have started rolling out the feature prior to full launch as deposits are not yet available for all square has been putting a lot of money into bitcoin, which has generated $65.5 million in revenue in just the first quarter of 2019. Taxes are not payable in every country. Scan the qr code to add the recipient's address. So, for example, say your salary was paid in part cash and part bitcoin, and each month you received $1000 worth of bitcoins.

ads/bitcoin1.txt

Bitcoin tax law, however, remains vague today. When you sell your property and receive the cash value of that gain, the gains become realized, and you have a taxable. How is the proceeds amount calculated on the form? Square's cash app makes it simple to send and receive money, but it is limited to domestic transfers. After the internal revenue service (irs) released their march 2014 guidance on bitcoin tax responsibilities, san jose state university professor annette nellen helped the american institute of cpas draft a request for further guidance on bitcoin tax law.

Bitcoin, just like ethereum and other cryptocurrencies, is treated as property for tax purposes.

ads/bitcoin2.txt

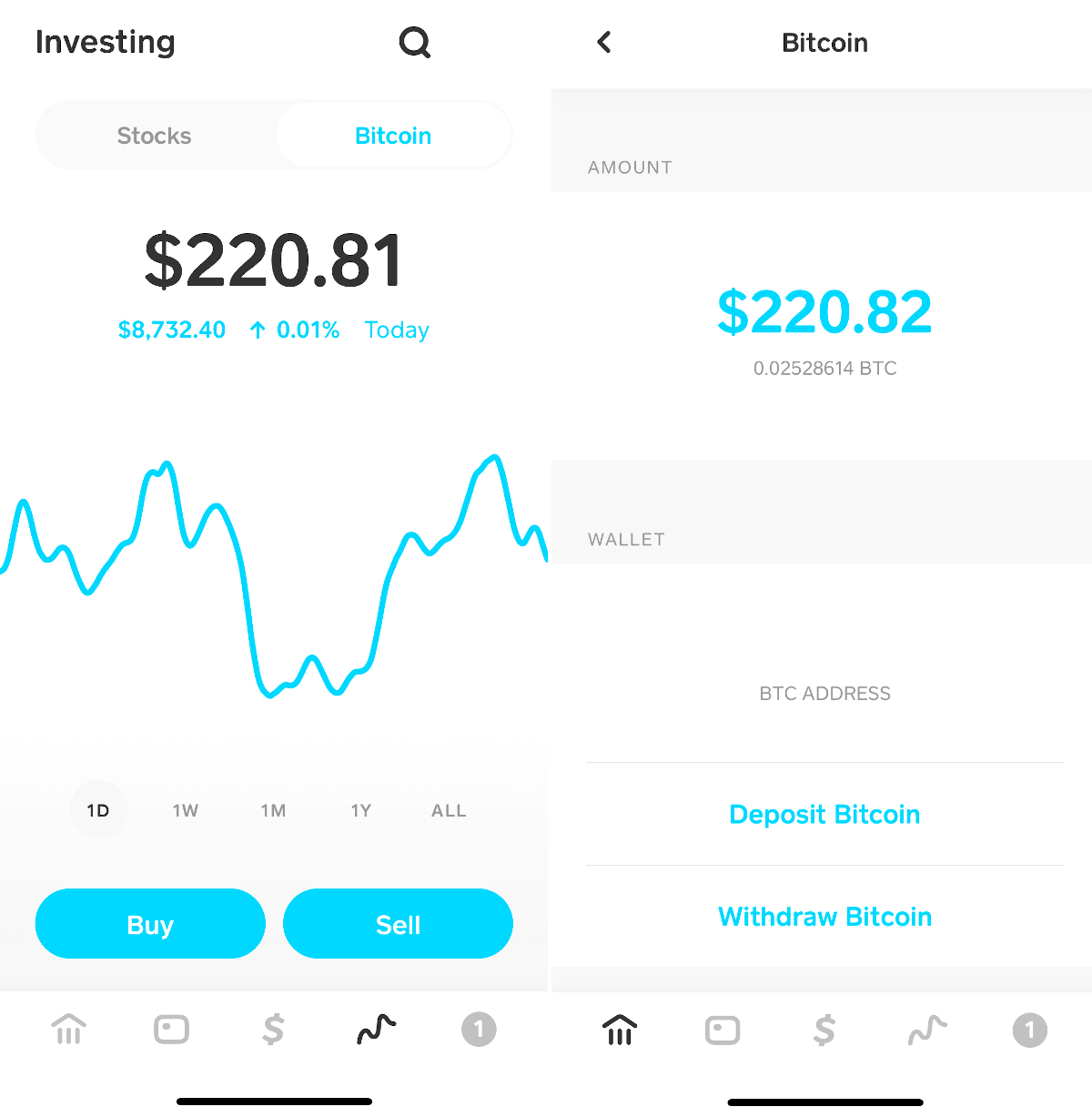

Other features available include withdrawals, deposits, usd and btc storage, the option to link. Cash app users can buy and sell bitcoin, but cash app will charge two kinds of fees: Now you can also use cash app to buy bitcoin in paxful. Square's cash app makes it simple to send and receive money, but it is limited to domestic transfers. Users from most states are able to make dollar and bitcoin transfers between their peers and businesses that also have cash app. When you sell your property and receive the cash value of that gain, the gains become realized, and you have a taxable. Until 2019, this fee was baked into the exchange rate, but in the interest of transparency. If i buy bitcoin using cash app and withdraw it, will the government know and require me to pay taxes on that withdrawal? The net investment income tax. So, for example, say your salary was paid in part cash and part bitcoin, and each month you received $1000 worth of bitcoins. I know that you can buy on localbitcoin and that is a way of being able to trade. Crypto tax software for beginners and traders. Does cash app work in all countries?

If i buy bitcoin using cash app and withdraw it, will the government know and require me to pay taxes on that withdrawal? Does cash app work in all countries? I know that you can buy on localbitcoin and that is a way of being able to trade. Square's cash app is launching bitcoin deposits, coindesk writes. Coinbase charges around 3.99% for credit/debit card purchases and 1.49% for bank transfer purchases.

Coinbase charges around 3.99% for credit/debit card purchases and 1.49% for bank transfer purchases.

ads/bitcoin2.txt

I've been using robinhood and they send my info directly to the irs but i don't think cash app does. Taxes are not payable in every country. Other features available include withdrawals, deposits, usd and btc storage, the option to link. How much tax will you pay? * receive your paycheck up to two days early * deposit paychecks, tax returns, unemployment benefits, government stimulus payouts and more directly into your cash app balance using your account and routing number. How do crypto taxes work in the us? How is the proceeds amount calculated on the form? Paxful makes the process of purchasing btc with cash app whole lot simpler. Scan the qr code to add the recipient's address. A service fee for each transaction and, depending on market activity, an additional fee determined by price volatility across u.s. If i buy bitcoin using cash app and withdraw it, will the government know and require me to pay taxes on that withdrawal? Thus, square's cash app doubles as a bitcoin exchange and custodial the content of this website is provided for informational purposes only and can't be used as investment advice, legal advice, tax advice, medical. Now you can also use cash app to buy bitcoin in paxful.

Crypto tax software for beginners and traders. Tax reporting with cash app for business. For any specific tax advice, please reach out to a qualified tax advisor. If i buy bitcoin using cash app and withdraw it, will the government know and require me to pay taxes on that withdrawal? Cash app (formerly known as square cash) is a mobile payment service developed by square, inc., allowing users to transfer money to one another using a mobile phone app.

Crypto tax software for beginners and traders.

ads/bitcoin2.txt

Things to consider about cash app. Cointracker integrates directly with square cash app to make tracking your balances, transactions and crypto taxes easy. After the internal revenue service (irs) released their march 2014 guidance on bitcoin tax responsibilities, san jose state university professor annette nellen helped the american institute of cpas draft a request for further guidance on bitcoin tax law. Crypto tax software for beginners and traders. Cash app allows you to instantly send money between friends or accept card payments for your business. Thus, square's cash app doubles as a bitcoin exchange and custodial the content of this website is provided for informational purposes only and can't be used as investment advice, legal advice, tax advice, medical. Tax reporting with cash app for business. As of february 18, 2018, the service recorded 7 million active users. When you sell your property and receive the cash value of that gain, the gains become realized, and you have a taxable. Does cash app work in all countries? Use our bitcoin tax calculator and save taxes on capital gains. If i buy bitcoin using cash app and withdraw it, will the government know and require me to pay taxes on that withdrawal? Square's cash app lets you instantly buy, sell, store, withdraw, and deposit bitcoin.

ads/bitcoin3.txt

ads/bitcoin4.txt

ads/bitcoin5.txt

0 Komentar

Post a Comment